In this blog, we’ll be coming across the actual meaning of Macroeconomics, it’s variables and Brazilian economy as a whole.

MACROECONOMICS

Macroeconomics is a branch of economics which includes regional, national and global economies that deals with the performance, structure, behaviour, and decision-making of an economy as a whole. So, basically it studies how an overall economy that is the market systems that operate on a large scale behaves. Macroeconomics study several variables like GDP, GNP, CPI, Inflation, Price levels, Rate of Economic Growth(refers to an increase in aggregate production in an economy), National income, Per Capita income, Exports & Imports, changes in unemployment etc. out of which GDP, unemployment rate, and the inflation rate are the three most important variables.

MACROECONOMIC VARIABLES:

- GDP(Gross Domestic Product) measures the value of economic activity or say, the market value of all final goods and services produced in a specific time period, often annually within a country.

- GDP = private consumption + gross investment + government investment + government spending + (exports – imports).

- GNP(Gross National Product) is an estimate of the total value of all the final products and services turned out in a given period by the means of production owned by a country’s residents.

- GNP = Consumption + Investment + Government + X (net exports, or imports minus exports) + Z (net income earned by domestic residents from overseas investments – net income earned by foreign residents from domestic investments.)

- National Income refers to the money value of all the goods and services produced in a country during a financial year. Basically, the final outcome of all the economic activities of the nation during a period of one year.

- PCI(Per Capita Income) also known as average income measures the average income earned per person in a given area (city, region, country, etc.) in a specified year. It is calculated by dividing the area’s total income by its total population.

- CPI(Consumer Price Index) measures changes in the price level of a weighted average market basket of consumer goods and services purchased by households. It is used for estimation of price changes in a basket of goods and services representative of consumption expenditure in an economy is called consumer price index.

- CPI = (Cost of basket in current period/Cost of basket in base period) × 100.

- Exports In International Trade, it is the goods or services produced in one country that is bought by someone in another country. The seller of such goods and services is an exporter; the foreign buyer is an importer. Net Exports = Value of Exports – Value of Imports

- Imports are foreign goods and services bought by residents of a country. Residents include citizens, businesses, and the government. The buyer of such goods and services is an importer; and the seller of that product is an exporter.Net Imports = Total value of spending of the home country on the goods and services imported from foreign countries.

BRAZIL

Brazil, being the largest country in South America, also is the fifth largest country in the world, exceeded in size only by Russia, China, Canada and the United States. Brazil is a country with long-standing ambitions for a major role in the world economy and in global governance, but its footprint in various measures of both remains relatively modest. On current trends, the gap between ambition and achievement will likely remain large.Brazil is a country with long-standing ambitions for a major role in the world economy and in global governance, but its footprint in various measures of both remains relatively modest. On current trends, the gap between ambition and achievement will likely remain large. Brazil experienced a period of economic and social progress between 2003 and 2014, when more than 29 million people left poverty and inequality declined significantly.Since 2015, however, the pace of poverty and inequality reduction seems to have stagnated. In the wake of a strong recession, Brazil has been going through a phase of highly depressed economic activity. 2017 saw the beginning of a slow recovery in Brazil’s economic activity, with 1.1% of GDP growth in 2017 and 2018 – largely because of a weak labor market, investments deferred by uncertainties about the elections and the truckers’ general strike, which brought economic activities to a halt in May of 2018. Brazil also needs to accelerate productivity growth and infrastructure development. The average income of Brazilian citizens has increased only 0.7% per year since the mid-1990s.Brazil’s productivity problem can be attributed to the absence of an adequate business environment, distortions created by market fragmentation, several support programs for companies that have yet to yield any results, a market that is relatively closed to foreign trade and little domestic competition.

ANALYSIS

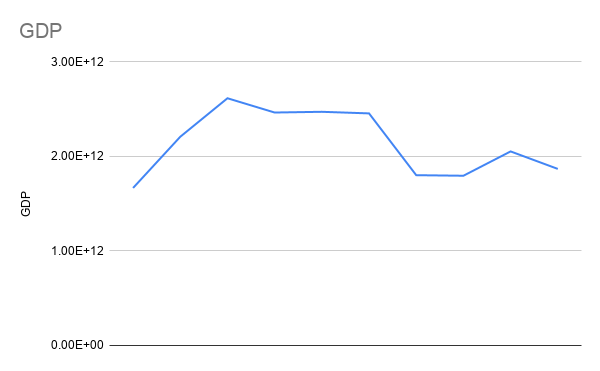

GDP of Brazil

After decades of rapid economic growth and per capita income gains, Brazil is struggling. According to the International Monetary Fund, the country’s GDP is poised to contract by more than 7% in 2015-2016.there is the structural trend of rising primary government expenditure as a share of GDP, which reached 36% in 2014, up from 22% in 1991. This increase reflected a political desire to address the poverty and inequality that had gone unaddressed during previous decades. To support the increase, Brazil’s government increased taxes on consumption and promoted progress toward labor-market formalization. Nonetheless, public investment, particularly in infrastructure, took a hit.The problem is that Brazil allowed high commodity prices simply to reinforce the underlying growth model, instead of preparing its economy for the inevitable bust. Profitability levels in the manufacturing industry were crushed by exchange-rate appreciation and rising domestic production costs, and levels of production practically stagnated from 2008, before starting to decline in 2014. As of now,in an effort to minimize the budget deficit, the authorities have proposed new tax measures, including new rules on capital gains and the reenactment of a tax on financial transactions.Among the expenditures that will come up for review are pensions, as social security expenditure probably reached close to 8% of GDP last year. Efforts to make the labor market more flexible and reduce the cost of tax compliance will also help to improve Brazil’s investment scenario. President Temer wants to pass reform to slash pension benefits, which represent nearly half of the country’s expenditures before debt-servicing costs. He is expected to have to rely on rate cuts as the fiscal crisis limits his ability to provide other stimulus. The president said the drop in rates showed the conditions for a recovery are now in place.

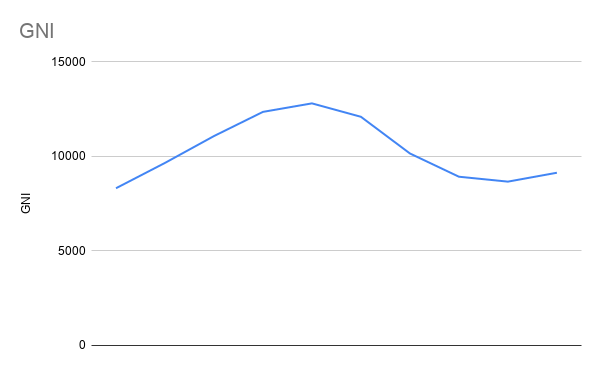

GNI of Brazil

Brazil is a large and closed economy.Brazil is also a relatively closed economy: the export and import share to GDP is only 20.2% and two other facts, taken together, complicate its inflation dynamics is that Brazil is a low savings economy whose export basket is heavily reliant on commodity exports. The average gross savings-to GDP ratio over the last five years has been only 17.7% A large part (23.8%) of Brazil’s CPI basket is composed of prices set by contract or by the government, so-called “regulated” prices. These have created problems for inflation dynamics in two ways – First, many of these prices are not set according to fixed, transparent formulas. Thus, they may go through long periods of being below or, like now, far above overall inflation. Second, they may also be used to try to make up for shortfalls in tax revenues. The Central Bank of Brazil still has all the necessary tools to deliver inflation at its target. Nonetheless, these factors do make inflation control more difficult and generate costs to society by causing inflation and interest rates to be, in general, higher and more volatile than necessary.

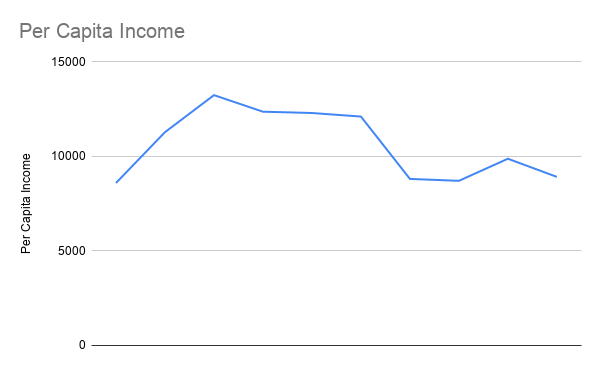

Per Capita Income of Brazil

Brazil gni per capita for 2018 was $9,140, 5.42% increase from 2017.Brazil gni per capita for 2017 was $8,670, 2.91% decline from 2016.Brazil gni per capita for 2016 was $8,930, 12.11% decline from 2015.Brazil gni per capita for 2015 was $10,160, 16.03% decline from 2014 and so on and so forth. Brazil has some of the fundamental components of what it takes to make its economy strong, but if it wants to truly improve the lives of its citizens then it will need to develop greater productivity and increase its international competitiveness. In recent years, Brazil’s economy has experienced some trouble, The country depends on its export-driven commodity trade, and China’s slowing demand for these products is a lightning strike. On the upside, the trade war between China and the U.S. has increased demand for Brazilian exports in agriculture and natural resources. Hence, the fluctuations in this particular variable is not as much as compared to the other variables.

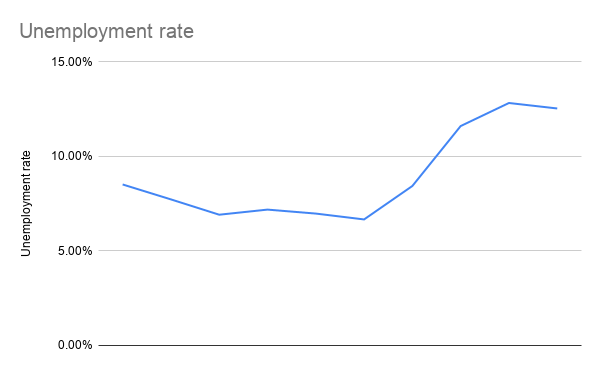

Unemployment Rate of Brazil

The World Bank provides data for Brazil from 1991 to 2018. The average value for Brazil during that period was 8.48 percent with a minimum of 6.03 percent in 1993 and a maximum of 12.83 percent in 2017.The unemployment rate in Brazil and other countries is defined as the number of unemployed people as percent of the labor force. The labor force includes the people who are either employed or unemployed, i.e. who don’t have a job but are actively looking for one. The labor force does not include people who are not looking for work, children, and the retired.The unemployment rate seldom declines below 4-5 percent even during boom times. There are always people who move between different sectors of the economy or between cities. When the economy goes into recession, then unemployment can reach much higher numbers, sometimes even in the double digits. As of now, the unemployment rate has increased to 12.7%With Brazil being the most populated country in South America, their economy has the potential to be one of the strongest in the world. However, with over 14 million Brazilians unemployed and unemployment rate hitting an all time high in 2017 at 13.6%, things aren’t looking so good for Brazil’s economy.

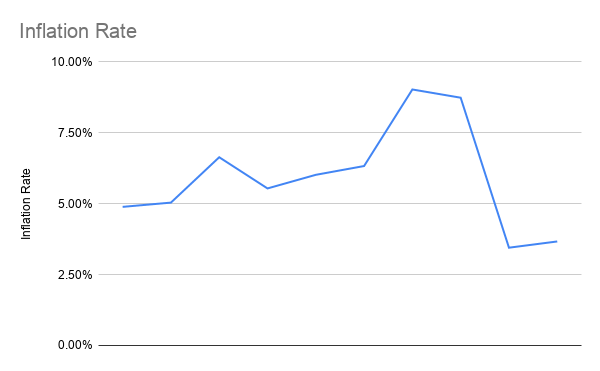

Inflation Rate in Brazil

In 2018, inflation rate for Brazil was 3.7 %. Though Brazil inflation rate fluctuated substantially in recent years, it tended to decrease through 2008 – 2018 period ending at 3.7 % in 2018.When world metal prices began to fall in 2011, followed by food prices in 2014, Brazil’s economy lost its growth levels. Over the last year, Brazil’s central bank was driven to increase interest rates. There was also a multibillion-dollar corruption scandal last year which engulfed the state-controlled oil company Petrobras, prompting a far-reaching investigation of high-level politicians and triggering a collapse of private investment. These are the reasons for the high inflation in the economy. There has been a lot of fluctuations in the inflation rate of Brazil’s economy which has all occurred because of the above mentioned reasons.

CONCLUSION

Brazil being one of the largest countries with one of the largest economies has faced a lot of fluctuations and crisis over these many years but is slowly working on what has to be worked on and is getting better. Brazilian government is coming up with a lot of policies in order to improve the economic conditions of the country which will need the improvisation in the political conditions of the country and also the policy making and several other factors. Over the passing years, the conditions of the country is clearly getting better because of the improvisation that the government of Brazil is coming up with.

SOURCES OF REFERENCE

Well researched and explained

LikeLiked by 1 person

Great Work.

LikeLiked by 1 person

Excellent job surbhi👍Good and keep on doing research and hard work.

LikeLiked by 1 person

Wonderful explaination 👏 keep up the good work keep posting 👌

LikeLiked by 1 person

Well researched…. Good work

LikeLiked by 1 person

Keep up the good work. It explains pretty much everything about Brazilian economy! 👍🏻

LikeLiked by 1 person

Precise research and very elaborate.

LikeLiked by 1 person

A great blog for anyone wanting to glimpse into the economics of Brazil. Great work

LikeLiked by 1 person

Good content ! Very informative !!

LikeLiked by 1 person

Good work keep it up

LikeLiked by 1 person

Well done but could have been more descriptive!

LikeLiked by 1 person

Great work ! .. a brief explanation of macroeconomics and Brazil’s past and present economic volatility.

LikeLiked by 1 person

Good job surbhi👍🏻

Keep doing good✨

LikeLiked by 1 person